Coffer Corporate Leisure completes sale of Green Belt portfolio

September 26, 2018

Coffer Corporate Leisure has completed the sale of a leisure portfolio – known as the Green Belt Portfolio – comprising eight high-quality freehold public house, restaurant, retail investment properties for circa £19.5 million to Kames Property Income Fund.

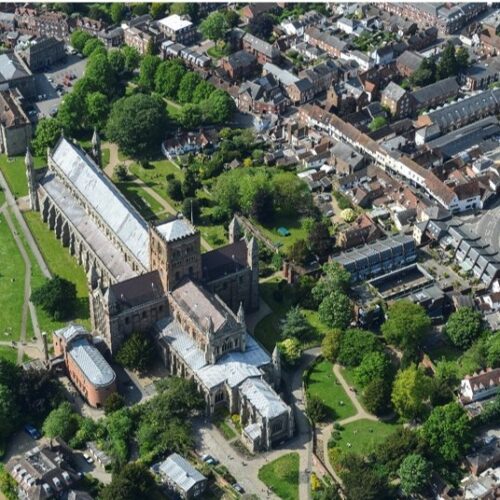

Coffer Corporate Leisure advised the seller, a private UK investor, who built the portfolio over 20 years selectively purchasing and asset managing landmark properties in affluent locations. Portfolio highlights include a high-end restaurant in St Albans that commenced trading as The Ivy Brasserie in May 2018 following a tenant investment thought to be in the region of £750k; a public house, The White Horse, in the affluent market town of Beaconsfield let to Brunning and Price; and successful table tennis themed bar, Smash/Coalition, situated in a central location in Reading. The locations of other assets included St Albans, Stratford-upon-Avon, Gerrards Cross and Reading and the tenant line-up included a number of high profile corporate operators such as JD Wetherspoon, Stonegate Pub Company, Brunning and Price (The Restaurant Group), Caprice Holdings (The Ivy) and Premium Dining Restaurants and Pubs Limited (Greene King Plc).

Mark Sheehan, Managing Director of Coffer Corporate Leisure said “Appetite for exceptionally located properties remains very strong. It is no secret that the best properties in the best locations are resilient to turbulence in macro or micro economies. For this reason, we are observing a “rush to quality” where investors are competing for the best assets. This is contracting prime yields further and perpetuating the polarisation between prime and secondary assets. We were delighted with the depth of market interest in the portfolio, our client received numerous bids on both the portfolio and individual assets.”

Coffer Corporate Leisure advised the vendor. Lewis and Partners represented the purchaser.