July sales down 6% on pre-COVID-19 levels at managed restaurants, pubs and bars

August 17, 2021

- Restaurants outperform pubs while bars enjoy ‘freedom day’ boost

- Sales struggle in London but hold up beyond the M25

- Rolling 12-month sales to end July down 20%

Britain’s managed pub, restaurant and bar groups lifted sales back close to pre-COVID-19 levels in July to continue hospitality’s recovery from the pandemic, the new edition of the Coffer CGA Business Tracker reveals.

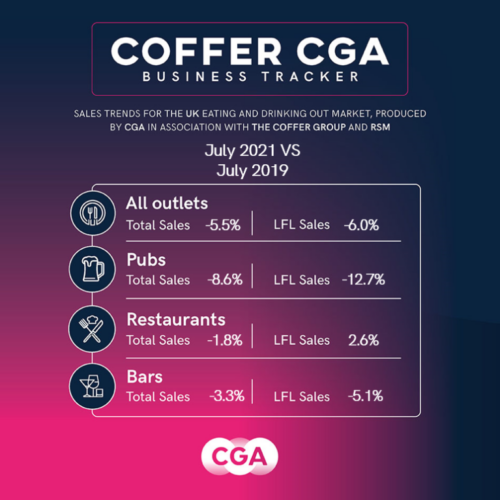

The Tracker, produced by CGA in partnership with The Coffer Group and RSM, shows total sales were just 6% down on the same month two years ago in 2019. Restaurants had a particularly strong month, with sales only 2% below 2019, while drink-led pubs and pub restaurants were down 9% and 8% respectively. Bars benefited from the easing of restrictions on the late-night sector, as sales ended 3% short of 2019.

Managed venues benefited from generally good weather in July and the popularity of ‘staycations’ at the start of the school holidays. Domestic tourism contributed to a much better July for regions beyond London than the capital: sales outside the M25 were down by 2% year-on-year, but within the M25 they dropped 15% as visitor and worker numbers remained low.

July’s solid performance comes despite a host of challenges for hospitality businesses, including widespread staffing shortages relating to recruitment issues and the ‘pingdemic’, supply problems and ongoing caution among some consumers. The Tracker also shows the lasting impacts of COVID-19 on hospitality, with rolling 12-month sales to the end of July 2021 down by 20% on the previous 12 months to July 2020—a period which included the country’s first full national lockdown.

Karl Chessell, director – hospitality operators and food, EMEA at CGA, said: “While sales are still some way short of what we would expect at this time of year, July was another steady month of recovery for hospitality. Restaurants are enjoying the release of latent demand for meals out, and the return of nightclubs and late-night bars was a milestone in the journey back to normality for the drinking out sector. Trading conditions remain difficult though, and the 20% drop in rolling sales since July 2020 highlights COVID-19’s heavy toll on the sector and the need for continued support. On top of major operational challenges, it means that not all businesses are out of the woods yet.”

Mark Sheehan, managing director at Coffer Corporate Leisure, said: “It’s not really like for like because so many factors are different in 2021 against 2019 but these numbers do demonstrate that on a national basis consumers are increasingly confident to go out. Much behaviour is different, and more time is spent closer to home but the numbers overall are steadily improving. The future is getting brighter.”

Saxon Moseley, leisure and hospitality partner at RSM said, “With the arrival of “Freedom Day” and a successful Euro football campaign, the eating and drinking out market enjoyed a further resurgence in July with like for like sales closing in on pre-pandemic levels. Given the disruption of staff availability and delivery of supplies caused by the “pingdemic”, this represents a real achievement for the sector. As Covid-19 case numbers stabilise, the number of fully-vaccinated adults rises and with a thriving staycation market keeping holidaymakers’ leisure spending in the UK, there is optimism moving into August of a return to trading levels not seen since 2019.”

A total of 56 companies provided data to the latest edition of the Coffer CGA Business Tracker.

Participating companies receive a fuller detailed breakdown of monthly trading. To join the cohort, contact Andrew Dean at andrew.dean@cgastrategy.com.

About Coffer CGA Business Tracker

CGA collected sales figures directly from 55 out of the 61 leading companies participating. Participants include: All Star Lanes, Amber Taverns, Anglian Country Inns, Azzurri Group (Ask Italian, Zizzi), Banana Tree Restaurants, Beds and Bars, Big Table Group (Bella Italia, Las Iguanas), Boparan Restaurant Group (Carluccio’s, Gourmet Burger Kitchen), Bill’s Restaurants, BrewDog, Buzzworks Holdings Group, Byron, Coaching Inn Group, Cote Restaurants, Dominion Hospitality, Drake & Morgan, Fuller Smith & Turner, Gaucho Grill, Giggling Squid, Greene King (Chef & Brewer, Hungry Horse, Flaming Grill), Gusto Restaurants, Hall & Woodhouse, Hawthorn Leisure, Honest Burgers, Laine Pub Co, Le Bistrot Pierre, Liberation, Loungers, Marston’s, McMullen & Sons Ltd, Mitchells & Butlers (Harvester, Toby, Miller & Carter, All Bar One), Mowgli, Nando’s Restaurants, New World Trading Co, Oakman Inns, Peach Pubs, Pizza Express, Pizza Hut UK, Prezzo, Punch Pub Co, Rekom UK, Restaurant Group (Frankie & Bennys, Chiquitos, Brunning & Price), Revolution Bars, Riley’s, Rosa’s Thai, Snug Bar, Southern Wind Group (Fazenda), St Austell, Star Pubs & Bars, State of Play Hospitality, Stonegate Pub Co (Slug & Lettuce, Yates’, Walkabout, Bermondsey Pub Company), Tattu Manchester, TGI Fridays UK, The Alchemist, True North Brew Co, Upham Pub Co, Various Eateries (Strada, Coppa Club), Wagamama, Whitbread (Beefeater, Brewers Fayre, Table Table), YO! Sushi and Youngs.

About CGA:

CGA is the definitive On Premise measurement, insight and research consultancy that empowers the world’s most successful food and drink brands. With more than 30 years’ experience and best-in-class research, data and analytics, CGA is uniquely positioned to help On Premise businesses develop winning strategies for growth.

CGA works with food and beverage suppliers, consumer brand owners, wholesalers, government entities and pub, bar and restaurant retailers to protect and shape the future of the On Premise experience. Its mission is to use phenomenal data and expert insights to give brands a competitive edge and ensure the market we love is the most vibrant possible.

To learn more, visit: www.cgastrategy.com