10 December 2021

Concerns mount over COVID-19 measures impacting fragile recovery as November sales held steady

Total Like For Like Sales Growth

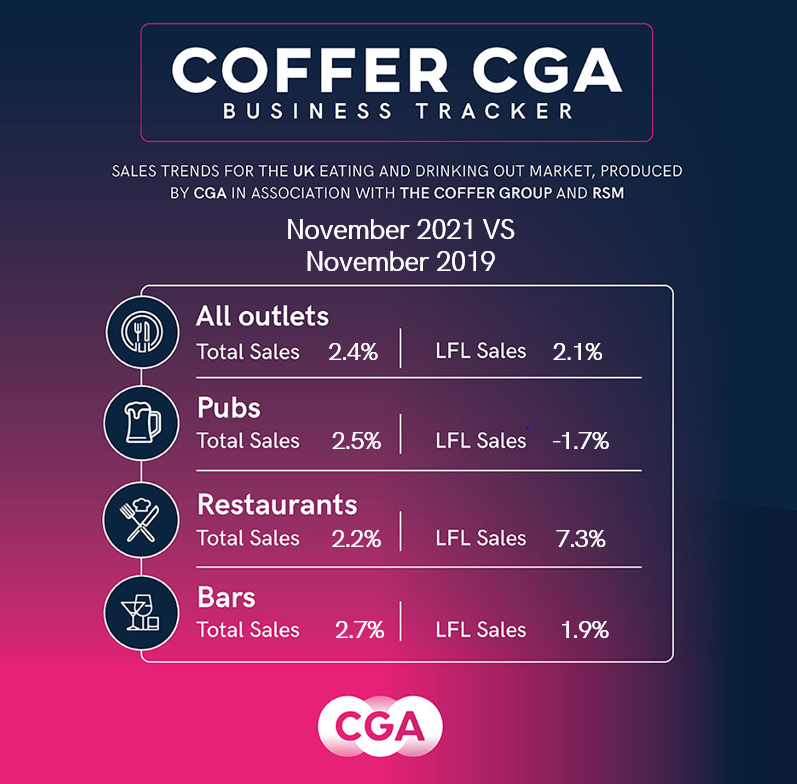

Britain’s managed pub, bar and restaurant groups recorded tentative sales growth in November, the new edition of the Coffer CGA Business Tracker reveals – but with the news of restrictions due to the Omicron variant of COVID-19, supply and staffing all rising, Christmas trading is under severe pressure.

- Groups’ total sales 2% ahead of pre-pandemic November levels

- Trading down in London with commuters and visitors still hesitant

The Tracker, produced by CGA in partnership with The Coffer Group and RSM, shows groups’ total sales in November were up by 2% on the pre-COVID-19 levels of November 2019. The pub and bar sectors both achieved sales growth of 3%, just ahead of restaurants at 2%.

It is the fourth month in a row that 2021 sales have exceeded 2019 levels. However, the rate has dropped from 8% in September and 3% in October, and November’s 2% growth is below most current inflation estimates. Rising costs in food, drink, energy and other key inputs have put operators’ margins under strain, while supply issues and staff shortages have added to their challenges. Concerns around the impact of ‘Plan B’ restrictions announced by the Government this week will further dent consumer confidence and restrict trading in the most important month of the year for pubs, bars and restaurants.

The Tracker highlights contrasting fortunes for groups in London, where total sales dipped by 2%; and venues outside the M25, where they rose by 4%. It suggests the capital is still suffering from an absence of office workers and domestic and international visitors.

Karl Chessell, director – hospitality operators and food, EMEA at CGA, said: “November’s sales figures demonstrate the resilience of managed groups in the face of ferocious headwinds. They have battled hard to shore up sales ever since their venues reopened in the Spring, but the new COVID-19 variant adds yet another threat to trading in the most important month of the year. The next few weeks will be crucial to give hospitality some momentum for growth in 2022, but new restrictions may threaten the future of thousands of fragile businesses and jobs.”

Mark Sheehan, managing director at Coffer Corporate Leisure, said: “This is a fragile recovery. November’s sales were relatively strong, but the current uncertainty is going to hit Christmas badly. However, the outlook is much brighter and despite some bumps in the road we expect a strong 2022.”

Paul Newman, head of leisure and hospitality at RSM, said: “November continues the recent downward trajectory of sales growth compared to 2019, falling to 2% in November vs 8% in September, as cancellations due to Omicron trepidation start to hit the sales of many hospitality businesses. As we head into final preparations for the holiday season, it’s unclear how the new COVID-19 variant and further restrictions will impact socialising and consumer confidence. Operators will be desperately hoping that Brits go ahead with plans to celebrate over the festive season with friends and family in their local hostelry to close out such a challenging year on a more positive note.”

CGA collected sales figures directly from 60 leading companies for the November edition of the Coffer CGA Business Tracker.

Participating companies receive a fuller detailed breakdown of monthly trading. To join the cohort, contact Andrew Dean at andrew.dean@cgastrategy.com.

About the Coffer CGA Business Tracker

Participants include: All Star Lanes, Amber Taverns, Anglian Country Inns, Azzurri Group (Ask Italian, Zizzi), Banana Tree Restaurants, Beds and Bars, Big Table Group (Bella Italia, Las Iguanas), Boparan Restaurant Group (Carluccio’s, Gourmet Burger Kitchen), Bill’s Restaurants, BrewDog, Buzzworks Holdings Group, Byron, Cityglen Pub Co, Cote Restaurants, Dishoom, Dominion Hospitality, Fuller Smith & Turner, Gaucho Grill, Giggling Squid, Greene King (Chef & Brewer, Hungry Horse, Flaming Grill), Gusto Restaurants, Hall & Woodhouse, Hawthorn Leisure, Honest Burgers, Laine Pub Co, Le Bistrot Pierre, Liberation, Loungers, Marston’s, McMullen & Sons Ltd, Mitchells & Butlers (Harvester, Toby, Miller & Carter, All Bar One), Mowgli, Nando’s Restaurants, Oakman Inns, Peach Pubs, Pizza Express, Pizza Hut UK, Prezzo, Punch Pub Co, Rekom UK, Restaurant Group (Frankie & Bennys, Chiquitos, Brunning & Price), Revolution Bars, Riley’s, Rosa’s Thai, Snug Bar, Southern Wind Group (Fazenda), St Austell, Star Pubs & Bars, State of Play Hospitality, Stonegate Pub Co (Slug & Lettuce, Yates’, Walkabout, Bermondsey Pub Company), Tattu Manchester, TGI Fridays UK, The Alchemist, True North Brew Co, Upham Pub Co, Various Eateries (Strada, Coppa Club), Wagamama, Whitbread (Beefeater, Brewers Fayre, Table Table), YO! Sushi and Young

About CGA:

CGA is the definitive On Premise measurement, insight and research consultancy that empowers the world’s most successful food and drink brands. With more than 30 years’ experience and best-in-class research, data and analytics, CGA is uniquely positioned to help On Premise businesses develop winning strategies for growth.

CGA works with food and beverage suppliers, consumer brand owners, wholesalers, government entities and pub, bar and restaurant retailers to protect and shape the future of the On Premise experience. Its mission is to use phenomenal data and expert insights to give brands a competitive edge and ensure the market we love is the most vibrant possible.

To learn more, visit: www.cgastrategy.com

Recent Reports:

- Rolling 12-month sales down 4.5% for managed pubs, bars and restaurants

- Managed restaurants, pubs and bars strong in September but challenges continue

- Rolling 12-month sales down 15%, but managed pubs, bars and restaurants show resilience with 5% growth in August

- July sales down 6% on pre-COVID-19 levels at managed restaurants, pubs and bars

- Rolling 12-month sales down 27%, but June provides cause for optimism as sales near 2019 levels