19 January 2022

Managed groups’ December sales dip 11% as Omicron hit consumer confidence

Total Like For Like Sales Growth

- Pubs and bars impacted most by drop in festive footfall

- London especially vulnerable, but regions more resilient

Britain’s managed restaurant, pub and bar groups suffered a double-digit drop on sales from pre-COVID-19 levels in December after widespread cancellations of Christmas celebrations, the latest edition of the Coffer CGA Business Tracker reveals.

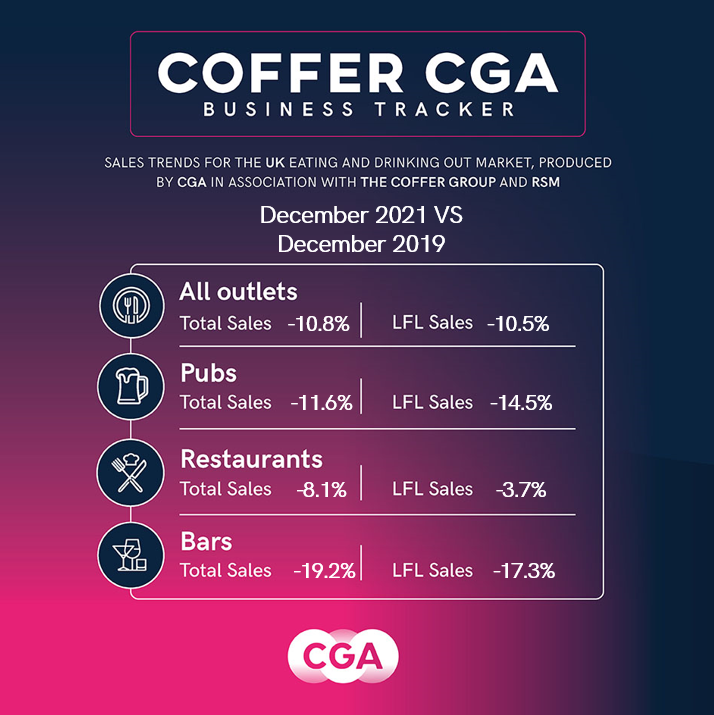

The Tracker, produced by CGA in partnership with The Coffer Group and RSM, shows groups’ total sales in the last month of 2021 were down by 11% on December 2019. It followed four successive months of 2021-on-2019 growth, and shows the damaging impact of the Omicron variant of COVID-19 on the hospitality sector, as many consumers opted to stay at home in the run-up to Christmas.

The Tracker indicates a tougher Christmas for managed pubs and bars, where sales were down by 12% and 19% respectively, than for restaurants, where they were down by 8%. It also highlights a particularly difficult month for London, with sales down by 19% within the M25—more than twice as big as the drop of 8% beyond the M25.

Karl Chessell, director – hospitality operators and food, EMEA at CGA, said: “These figures show the hugely damaging impact of consumers’ anxiety and restrictions on trading at what should have been the busiest time of year. Restaurant groups in particular did well to shore up sales as much as they did, but on top of rising costs, supply problems and staff challenges, the difficult December leaves many businesses without the buffer of cash they would normally rely on in January. Demand for eating and drinking out remains strong, but the sector needs support on tax and other pressures if it is to help power the UK’s economic recovery when COVID-19 restrictions finally ease.”

David Coffer, chairman at Coffer Corporate Leisure, said: “The results are not surprising. If anything, many anticipated worse. The pre-Christmas growth was euphoric and in stark contrast to the major drop-off in the most important trading months of the year. The industry lives in hope that the impending lifting of restrictions, especially working from home, will see a spike in demand in the early part of the year. The industry is desperately in need of cash injection and there are many, no doubt, who will be on the brink of closure as a result of the impact of Omicron. The spectre of debt in so many forms is ever becoming a reality and we may well see an abundance of casualties throughout the industry as a result. London was a virtual desert throughout the seasonal period as a result of the restrictions of congestion charge, parking and health warnings which made punters consider a visit to the central core over the festive period with great caution.

The big question is whether the culture of central city leisure has changed irreversibly – only time will tell.”

Paul Newman, head of leisure and hospitality at RSM, said: “Although not unexpected, these figures represent a devastating month for the UK eating and drinking out sector. December is such a crucial period for most operators, often representing three times the trade of a normal month. Alongside a fall in sales, profit margins will have been more acutely hit when stock wastage and lower staff productivity are factored in. The relaxation of Plan B restrictions cannot come soon enough, and I urge those customers who had their Christmas plans cancelled at short notice to rebook them in the coming weeks to support the recovery of their local pub or restaurant.”

CGA collected sales figures directly from 60 leading companies for the December edition of the Coffer CGA Business Tracker.

Participating companies receive a fuller detailed breakdown of monthly trading. To join the cohort, contact Andrew Dean at andrew.dean@cgastrategy.com.

About the Coffer CGA Business Tracker

Participants include: All Star Lanes, Amber Taverns, Anglian Country Inns, Azzurri Group (Ask Italian, Zizzi), Banana Tree Restaurants, Beds and Bars, Big Table Group (Bella Italia, Las Iguanas), Boparan Restaurant Group (Carluccio’s, Gourmet Burger Kitchen), Bill’s Restaurants, BrewDog, Buzzworks Holdings Group, Byron, Cityglen Pub Co, Cote Restaurants, Dishoom, Dominion Hospitality, Fuller Smith & Turner, Gaucho Grill, Giggling Squid, Greene King (Chef & Brewer, Hungry Horse, Flaming Grill), Gusto Restaurants, Hall & Woodhouse, Hawthorn Leisure, Honest Burgers, Laine Pub Co, Le Bistrot Pierre, Liberation, Loungers, Marston’s, McMullen & Sons Ltd, Mitchells & Butlers (Harvester, Toby, Miller & Carter, All Bar One), Mowgli, Nando’s Restaurants, Oakman Inns, Peach Pubs, Pizza Express, Pizza Hut UK, Prezzo, Punch Pub Co, Rekom UK, Restaurant Group (Frankie & Bennys, Chiquitos, Brunning & Price), Revolution Bars, Riley’s, Rosa’s Thai, Snug Bar, Southern Wind Group (Fazenda), St Austell, Star Pubs & Bars, State of Play Hospitality, Stonegate Pub Co (Slug & Lettuce, Yates’, Walkabout, Bermondsey Pub Company), Tattu Manchester, TGI Fridays UK, The Alchemist, True North Brew Co, Upham Pub Co, Various Eateries (Strada, Coppa Club), Wagamama, Whitbread (Beefeater, Brewers Fayre, Table Table), YO! Sushi and Youngs.

Recent Reports:

- Concerns mount over COVID-19 measures impacting fragile recovery as November sales held steady

- Rolling 12-month sales down 4.5% for managed pubs, bars and restaurants

- Managed restaurants, pubs and bars strong in September but challenges continue

- Rolling 12-month sales down 15%, but managed pubs, bars and restaurants show resilience with 5% growth in August

- July sales down 6% on pre-COVID-19 levels at managed restaurants, pubs and bars