15 February 2022

Managed groups’ January sales up 3% on pre-COVID-19 levels as restrictions ease

Total Like For Like Sales Growth

- Restaurants and pubs solid but vaccine passes hurt late-night sector

- Regions in good growth while London remains in the red

Rising consumer confidence about safety and the easing of COVID-19 restrictions helped Britain’s managed pub, bar, and restaurant groups to a modest increase in sales in January, the Coffer CGA Business Tracker reveals.

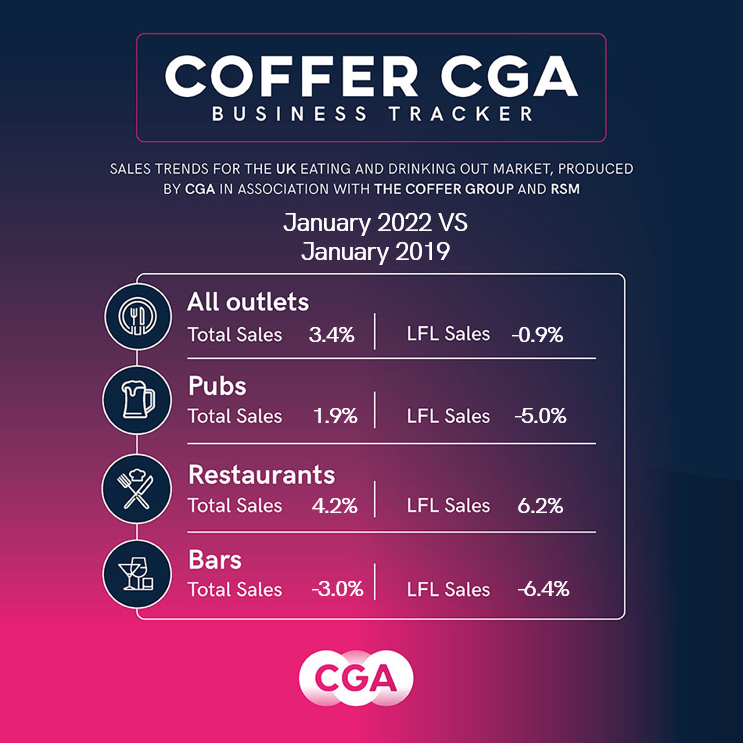

The latest edition of the Tracker, produced by CGA in partnership with The Coffer Group and RSM, shows groups’ total sales in the first month of 2022 were 3% higher than in January 2019. It represents a solid recovery from December, when heavy COVID-19 measures were in place and sales fell 11% below the levels of 2019.

Restaurants were the strongest performing segment of the market in January, recording 4% growth on January 2019, while pubs were up 2%. However, bars saw sales slip 3%, as the requirement for vaccination passes and lingering concerns about crowded venues dented late-night visits.

Continuing the pattern of recent months, trading was significantly weaker in London than elsewhere in Britain. Sales beyond the M25 were up by 6% on January 2019, but they dipped 8% within it, with office workers and tourists slow to return to the capital.

Karl Chessell, director – hospitality operators and food, EMEA at CGA, said: “After a bleak December for managed groups, January brought a reasonable revival. Growth for restaurants was particularly encouraging, and the challenging London and late-night markets should hopefully pick up as people return to offices and COVID-19 restrictions wind down. However, it’s important to note that sales growth remains below inflation. With some businesses vulnerable after a tough end to 2021, and consumers facing mounting costs of living, hospitality’s road to recovery still has a long way to run.”

Mark Sheehan, managing director at Coffer Corporate Leisure, said: “January saw steady improvement throughout from a slow start. It was only on 25th January that the government stopped guidance to work from home where possible. As working habits return closer to normal, we expect to see eating and drinking out to rebound steadily. London and other city centres are seeing very good numbers. There is cautious optimism for the sector.”

Paul Newman, head of leisure and hospitality at RSM, said: “January’s bounce back after the disappointment of December sees the sector make an encouraging start to the new financial year. With trading restrictions finally lifted and the Omicron variant easing, customer footfall numbers and card spending are getting stronger week by week. The sector is not without its challenges as COVID-19 reliefs begin to fall away but there is a strong sense of optimism among many operators, particularly around the return of office workers and tourists to city centres. We expect to see further consolidation in the sector over the coming months, led by a number of well capitalised larger groups looking to grow their estates and take advantage of the resurgence of demand in the pub and casual dining sectors.”

CGA collected sales figures directly from 60 leading companies for the January edition of the Coffer CGA Business Tracker.

Participating companies receive a fuller detailed breakdown of monthly trading. To join the cohort, contact Andrew Dean at andrew.dean@cgastrategy.com.

About the Coffer CGA Business Tracker

Participants include: All Star Lanes, Amber Taverns, Anglian Country Inns, Azzurri Group (Ask Italian, Zizzi), Banana Tree Restaurants, Beds and Bars, Big Table Group (Bella Italia, Las Iguanas), Boparan Restaurant Group (Carluccio’s, Gourmet Burger Kitchen), Bill’s Restaurants, BrewDog, Buzzworks Holdings Group, Byron, Cityglen Pub Co, Cote Restaurants, Dishoom, Dominion Hospitality, Fuller Smith & Turner, Gaucho Grill, Giggling Squid, Greene King (Chef & Brewer, Hungry Horse, Flaming Grill), Gusto Restaurants, Hall & Woodhouse, Hawthorn Leisure, Honest Burgers, Laine Pub Co, Le Bistrot Pierre, Liberation, Loungers, Marston’s, McMullen & Sons Ltd, Mitchells & Butlers (Harvester, Toby, Miller & Carter, All Bar One), Mowgli, Nando’s Restaurants, Oakman Inns, Peach Pubs, Pizza Express, Pizza Hut UK, Prezzo, Punch Pub Co, Rekom UK, Restaurant Group (Frankie & Bennys, Chiquitos, Brunning & Price), Revolution Bars, Riley’s, Rosa’s Thai, Snug Bar, Southern Wind Group (Fazenda), St Austell, Star Pubs & Bars, State of Play Hospitality, Stonegate Pub Co (Slug & Lettuce, Yates’, Walkabout, Bermondsey Pub Company), Tattu Manchester, TGI Fridays UK, The Alchemist, True North Brew Co, Upham Pub Co, Various Eateries (Strada, Coppa Club), Wagamama, Whitbread (Beefeater, Brewers Fayre, Table Table), YO! Sushi and Youngs.

About CGA:

CGA is the definitive On Premise measurement, insight and research consultancy that empowers the world’s most successful food and drink brands. With more than 30 years’ experience and best-in-class research, data and analytics, CGA is uniquely positioned to help On Premise businesses develop winning strategies for growth.

CGA works with food and beverage suppliers, consumer brand owners, wholesalers, government entities and pub, bar and restaurant retailers to protect and shape the future of the On Premise experience. Its mission is to use phenomenal data and expert insights to give brands a competitive edge and ensure the market we love is the most vibrant possible.

To learn more, visit: www.cgastrategy.com

Recent Reports:

- Managed groups’ December sales dip 11% as Omicron hit consumer confidence

- Concerns mount over COVID-19 measures impacting fragile recovery as November sales held steady

- Rolling 12-month sales down 4.5% for managed pubs, bars and restaurants

- Managed restaurants, pubs and bars strong in September but challenges continue

- Rolling 12-month sales down 15%, but managed pubs, bars and restaurants show resilience with 5% growth in August