14 March 2022

Managed groups’ grow like-for-like sales by 3% in February, but cost stresses mount

Total Like For Like Sales Growth

- Restaurants enjoy strong month while pubs lag pre-COVID-19 levels

- Regions in growth but London struggles to recover sales

The lifting of all COVID-19 restrictions helped Britain’s managed restaurant, pub and bar groups to raise sales above pre-pandemic levels in February, according to the latest Coffer CGA Business Tracker—but high inflation continues to make real-terms growth elusive.

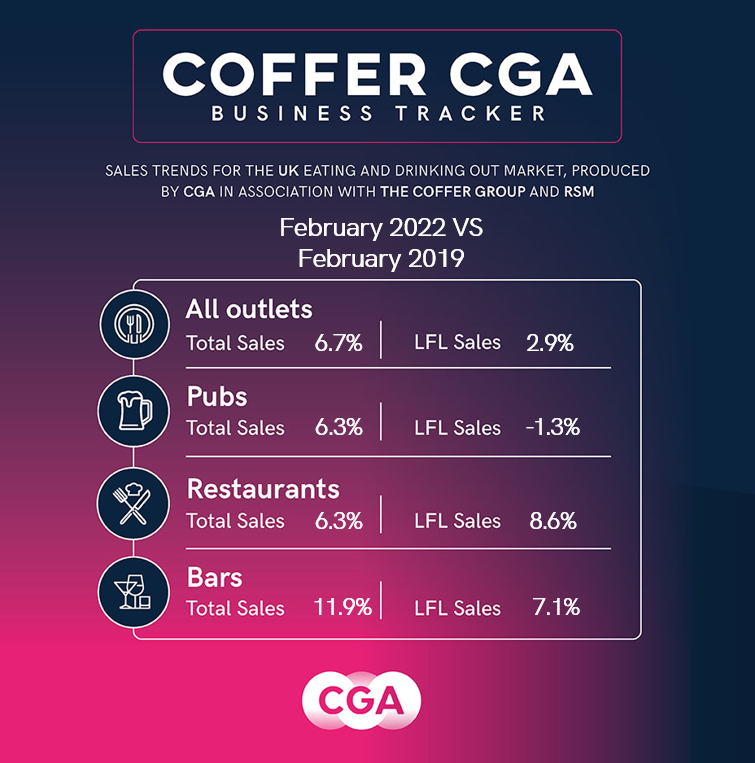

The Tracker, produced by CGA in partnership with The Coffer Group and RSM, reveals groups’ like-for-like sales in February were 3% higher than in February 2019. This builds momentum from January, when comparative sales were 1% down, and a very challenging December 2021, when the Omicron variant pushed trading 11% below December 2019.

Restaurants increased like-for-like sales by 9% in February, just outpacing the 7% growth for bars, which benefited from the scrapping of requirements for vaccination passes in late-night venues. Pubs had a tougher month, ending down 1% on the pre-COVID-19 levels of February 2019.

While the growth figures are encouraging, they are depressed by inflationary pressures. Recent editions of the Consumer Prices Index have shown that inflation is running at 5% to 6% over the last 12 months alone.

Trading is also struggling to recover in London, the Coffer CGA Business Tracker shows. Managed groups’ like-for-like sales inside the M25 in February were 4% below February 2019, compared to growth of 6% beyond the M25.

Karl Chessell, director – hospitality operators and food, EMEA at CGA, said: “These figures show managed groups are building momentum after two years of turmoil. Delivery and late-night bars are particularly buoyant at the moment, and underlying demand for hospitality experiences remains strong. However, margins are being tightly squeezed by fast-rising costs, and the cost-of-living crisis is likely to dent consumer spending as the year goes on. Some businesses remain extremely vulnerable, and there’s a powerful case for government support on tax and other issues to help them fuel the UK’s post-COVID-19 economic recovery.”

David Coffer, chairman at The Coffer Group, said: “There were no surprises in the higher level of February like-for-likes compared to 2019. It seems the market is striving to surge ahead but is held back by external pressures such as Omicron but also due to the general atmosphere regarding the current political situations being played out in Europe and the UK.

“London is seeing a marked difference in trade, which is clearly apparent at any time of day and night, in the sparsely populated streets of the central London Core. The effects of the Mayor’s parking, congestion and ULEZ measures are imposing a major negative impact on the cost of visiting the capital for dining and cultural purposes. The big question is whether this trend will reverse or whether London’s operators will suffer long-term from these measures as well as the cultural changes that have been imposed as a result of the Pandemic.”

“Most punters may well be asking “is it worth coming to London again at such a high cost in terms of pricing and inconvenience in travel apart from time wasted? I am hopeful that the overall trading in all sectors will improve but I am sure we will all be watching the central London statistics very carefully over the next few months. Hopefully, the return of overseas tourists, which is so sorely missed, will have a marked and positive effect.”

Paul Newman, head of leisure and hospitality at RSM, said: “The return to offices as well as an uptick in sales from Valentine’s Day falling on a Monday – typically the most subdued trading day of the week – gave a welcome boost to the hospitality sector in February. Despite storms Eunice and Franklin, Brits were keen to make the most of their social plans following the easing of restrictions. As the cost of living spirals upwards, operators will be hoping that consumers continue to favour experiences over “things”, especially as the key elements of COVID-19-related government support for the sector are set to fall away in April.”

CGA collected sales figures directly from 62 leading companies for the February edition of the Coffer CGA Business Tracker.

Participating companies receive a fuller detailed breakdown of monthly trading. To join the cohort, contact Andrew Dean at andrew.dean@cgastrategy.com

About the Coffer CGA Business Tracker

Participants include: All Star Lanes, Amber Taverns, Anglian Country Inns, Azzurri Group (Ask Italian, Zizzi), Banana Tree Restaurants, Beds and Bars, Big Table Group (Bella Italia, Las Iguanas), Boparan Restaurant Group (Carluccio’s, Gourmet Burger Kitchen), Bill’s Restaurants, BrewDog, Buzzworks Holdings Group, Byron, Cityglen Pub Co, Coaching Inn Group Ltd, Cote Restaurants, Dishoom, Dominion Hospitality, Fuller Smith & Turner, Gaucho Grill, Giggling Squid, Greene King (Chef & Brewer, Hungry Horse, Flaming Grill), Gusto Restaurants, Hall & Woodhouse, Hawthorn Leisure, Honest Burgers, Laine Pub Co, Le Bistrot Pierre, Liberation, Loungers, Marston’s, McMullen & Sons Ltd, Mitchells & Butlers (Harvester, Toby, Miller & Carter, All Bar One), Mowgli, Nando’s Restaurants, New World Trading Company, Oakman Inns, Peach Pubs, Pizza Express, Pizza Hut UK, Prezzo, Punch Pub Co, Rekom UK, Restaurant Group (Frankie & Bennys, Chiquitos, Brunning & Price), Revolution Bars, Riley’s, Rosa’s Thai, Snug Bar, Southern Wind Group (Fazenda), St Austell, Star Pubs & Bars, State of Play Hospitality, Stonegate Pub Co (Slug & Lettuce, Yates’, Walkabout, Bermondsey Pub Company), Tattu Manchester, TGI Fridays UK, The Alchemist, True North Brew Co, Upham Pub Co, Various Eateries (Strada, Coppa Club), Wagamama, Whitbread (Beefeater, Brewers Fayre, Table Table), YO! Sushi and Youngs.

About CGA:

CGA is the definitive On Premise measurement, insight and research consultancy that empowers the world’s most successful food and drink brands. With more than 30 years’ experience and best-in-class research, data and analytics, CGA is uniquely positioned to help On Premise businesses develop winning strategies for growth.

CGA works with food and beverage suppliers, consumer brand owners, wholesalers, government entities and pub, bar and restaurant retailers to protect and shape the future of the On Premise experience. Its mission is to use phenomenal data and expert insights to give brands a competitive edge and ensure the market we love is the most vibrant possible.

To learn more, visit: www.cgastrategy.com

Recent Reports:

- Managed groups’ January sales up 3% on pre-COVID-19 levels as restrictions ease

- Managed groups’ December sales dip 11% as Omicron hit consumer confidence

- Concerns mount over COVID-19 measures impacting fragile recovery as November sales held steady

- Rolling 12-month sales down 4.5% for managed pubs, bars and restaurants

- Managed restaurants, pubs and bars strong in September but challenges continue