21 September 2022

Hospitality groups’ August sales up from pre-COVID levels, but inflation wipes out growth

Total Like For Like Sales Growth

- Managed operators record modest 2.0% increase on 2019

- Restaurants the top performing sector but London struggles again

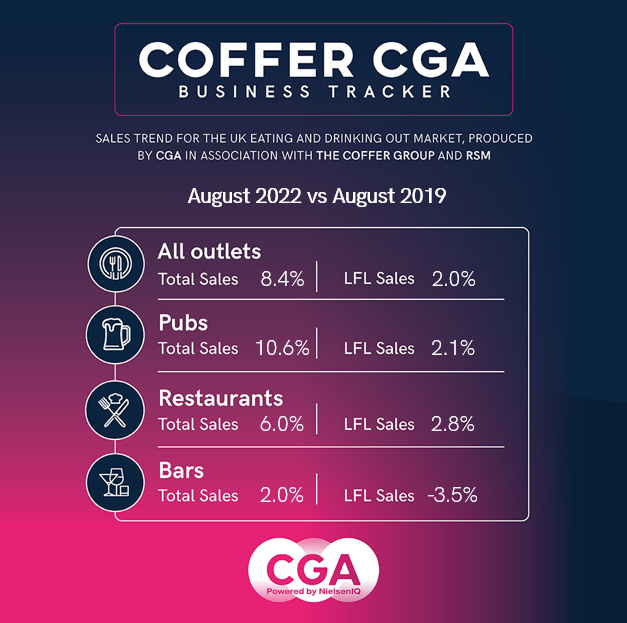

Like-for-like sales at Britain’s managed restaurant, pub and bar groups in August were 2.0% ahead of the pre-COVID-19 levels of August 2019, the new edition of the Coffer CGA Business Tracker shows.

The result from the Tracker—produced by CGA by NielsenIQ in partnership with The Coffer Group and RSM UK—means like-for-like sales have now been ahead of or level with pre-pandemic comparatives for seven months in a row. However, with compound inflation since 2019 in double digits, groups’ sales remain well below the levels of three years ago in real terms.

For the fifth successive month, restaurants were the strongest performing of the Tracker’s three hospitality segments in August, with like-for-like sales growth of 2.8%. Pubs’ sales were up by 2.1% on 2019, while bars’ sales were down by 3.5%.

As has been the case in most months since the start of the pandemic, trading in London was well behind many other parts of the country. The Tracker shows like-for-like sales within the M25 were down by 2.0% in August, compared to 3.2% growth beyond the M25. Venues in London continue to be affected by a dip in office workers and visitors since the start of the pandemic, and rail strikes have further reduced footfall.

The Tracker also highlights the increased demand for deliveries and takeaways since the start of COVID-19 restrictions. Despite their overall growth of 2.8% in August, restaurants’ dine-in only sales were 2.1% below those of August 2019—a sign that some consumers are now ordering meals in rather than eating out.

Karl Chessell, director – hospitality operators and food, EMEA at CGA, said: “It’s been pleasing to see managed groups’ sales beating pre-COVID levels for most of 2022—but the stark reality is that after adjusting for inflation, trading is lagging significantly behind. Hospitality is feeling the effects of the cost-of-living crisis as consumers watch their spending, and is facing soaring costs of its own across fuel, food, labour and other key inputs. With a difficult autumn and winter ahead, the sector needs urgent and bold help from government on energy and taxes to help protect businesses.”

Mark Sheehan, managing director at Coffer Corporate Leisure, said: “Flat sales against the backdrop of record inflation means for many that just getting through this period is all that matters for many hospitality businesses. Economic uncertainty during the summer may have kept some workers away from central London and the hope is that workers are now returning.”

Paul Newman, head of leisure and hospitality at RSM UK, said: “With like for like sales continuing their underwhelming trajectory when compared to 2019, the need for long term Government support for the UK eating and drinking out sector is becoming desperate. Many exceptional operators may be forced to take difficult decisions over the future of their business if the Government doesn’t confront the issues facing the hospitality industry. Whilst recently announced support for households should help shore up consumer demand, the assistance offered to businesses is less generous, with the period of support uncertain and with further clarity not expected for months. This is a lifetime away for a sector only just recovering from the last economic storm, and therefore we urge the Government to outline further support now so that businesses can trade confidently going into 2023.”

CGA collected sales figures directly from 65 leading companies for the latest edition of the Coffer CGA Business Tracker.

Participating companies receive a fuller detailed breakdown of monthly trading. To join the cohort, contact Andrew Dean at andrew.dean@cgastrategy.com

About the Coffer CGA Business Tracker

Participants include: Adventure Bars, All Star Lanes, Amber Taverns, Anglian Country Inns, Azzurri Group (Ask Italian, Zizzi), Banana Tree Restaurants, Barkby Pub Co, Beds and Bars, Big Table Group (Bella Italia, Las Iguanas), Bill’s Restaurants, Boparan Restaurant Group (Carluccio’s, Gourmet Burger Kitchen), BrewDog, Buzzworks Holdings Group, Byron, Cityglen Pub Co, Coaching Inn Group Ltd, Cote Restaurants, Dishoom, Dominion Hospitality, East London Pub Co, Five Guys, Fuller Smith & Turner, Gaucho Grill, Giggling Squid, Greene King (Chef & Brewer, Hungry Horse, Flaming Grill), Gusto Restaurants, Hall & Woodhouse, Hawthorn Leisure, Honest Burgers, Individual Restaurants, Junkyard Golf Club, Laine Pub Co, Le Bistrot Pierre, Liberation, Loungers, Marston’s, McMullen & Sons Ltd, Mitchells & Butlers (Harvester, Toby, Miller & Carter, All Bar One), Mowgli, Nando’s Restaurants, New World Trading Company, North Brewing Co, Oakman Inns, Parogon Pub Group, Peach Pubs, Pizza Express, Pizza Hut UK, Prezzo, Punch Pub Co, Rekom UK, Restaurant Group (Frankie & Bennys, Chiquitos, Brunning & Price), Revolution Bars, Riley’s, Rosa’s Thai, Snug Bar, Southern Wind Group (Fazenda), St Austell, Star Pubs & Bars, State of Play Hospitality, Stonegate Pub Co (Slug & Lettuce, Yates’, Walkabout, Bermondsey Pub Company), Tattu, TGI Fridays UK, The Alchemist, True North Brew Co, Upham Pub Co, Various Eateries (Strada, Coppa Club), Wagamama, Whitbread (Beefeater, Brewers Fayre, Table Table), YO! Sushi and Young’s.

About CGA by NielsenIQ:

CGA is the definitive On Premise measurement, insight and research consultancy that empowers the world’s most successful food and drink brands. With more than 30 years’ experience and best-in-class research, data and analytics, CGA is uniquely positioned to help On Premise businesses develop winning strategies for growth.

CGA works with food and beverage suppliers, consumer brand owners, wholesalers, government entities and pub, bar and restaurant retailers to protect and shape the future of the On Premise experience. Its mission is to use phenomenal data and expert insights to give brands a competitive edge and ensure the market we love is the most vibrant possible.

To learn more, visit: www.cgastrategy.com

Recent Reports:

- Managed groups’ like-for-like sales remain flat despite continued market turbulence

- Hospitality groups’ like-for-like sales up 5% in June, but inflation bites

- Managed groups’ like-for-like sales flat in May as cost crisis deepens

- Managed groups’ like-for-like sales up 2% in April, but cost pressures stunt growth

- Managed groups’ like-for-like sales up 4% in March, but inflation holds down growth