20 July 2022

Hospitality groups’ like-for-like sales up 5% in June, but inflation bites

Total Like For Like Sales Growth

- Jubilee holidays help restaurants, pubs and bars to solid growth

- London trading dips back below pre-COVID-19 levels after rail strikes

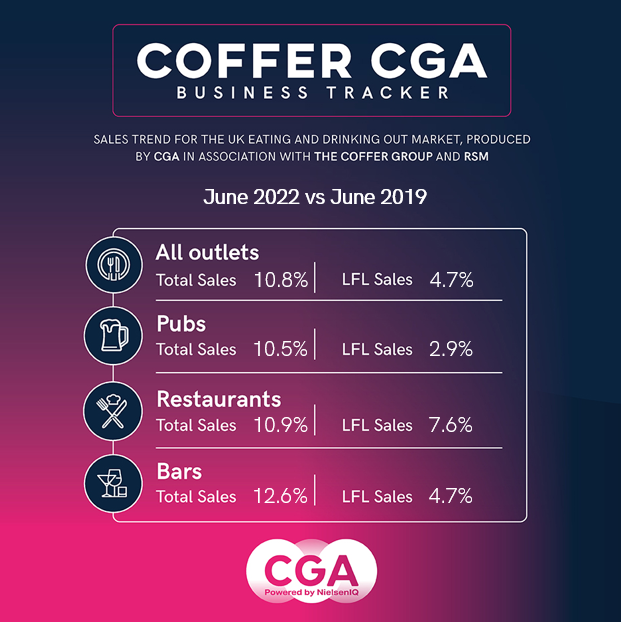

June’s like-for-like sales at Britain’s top managed restaurant, pub and bar groups were 5% ahead of the pre-COVID-19 levels of June 2019, the latest Coffer CGA Business Tracker reveals.

The result from the Tracker—produced by CGA by NielsenIQ in partnership with The Coffer Group and RSM UK—represents the strongest month of like-for-like growth since the start of 2022. However, June’s figures are skewed by the Queen’s Platinum Jubilee, which provided two Bank Holidays against none in June 2019. The growth is also below inflation as measured by the Consumer Price Index, which recently topped 9%.

Restaurants were the strongest performing of the Tracker’s three hospitality segments in June, with like-for-like growth of 8%. Pubs’ sales were up by 3% on three years ago, and bars’ sales rose by 5%.

Trading in London remains challenging, the Tracker shows. After a flat performance in May, like-for-like sales within the M25 were down by 1% in June, compared to 7% growth beyond the M25. It follows rail strikes over several days in June, which significantly reduced footfall from workers and visitors in London.

The Tracker also suggests that some consumers who have opted for deliveries since the start of the pandemic are now returning to eating out. Managed groups’ dine-in only sales were up by 2% on a like-for-like basis in June—the first time this year that they have been in line with total growth.

Karl Chessell, director – hospitality operators and food, EMEA at CGA, said: “Like-for-like sales growth of 5% would represent a strong performance for managed groups in most months. However, high inflation means sales are down in real terms, and mounting costs continue to pile pressure on profit margins. The first half of 2022 has brought some welcome stability to the hospitality sector, and consumers have returned to most of their pre-pandemic habits—but while the long-term outlook remains good, there may be some tough months ahead for many businesses.”

Mark Sheehan, managing director at Coffer Corporate Leisure, said: “We are seeing a very slow return to normality. There is a huge disparity amongst operators. Loungers at 17.9% like-for-likes on 2019 and Wetherspoons at 0.5% for example. Some operators and locations are trading well. Inflation and recruitment remains a priority.”

Paul Newman, head of leisure and hospitality at RSM UK, said: “With the late May bank holiday falling into June this year and the additional day for the Jubilee, operators saw a welcome boost to sales for the month. But even the Queen’s gift to the nation won’t reverse the wider economic challenges facing the sector. Stripping out the bumper bank holiday, and with sales growth tracking behind inflation, the underlying trend is still one of squeezed margins and flat sales. A new Prime Minister could be just the silver lining operators have been waiting for, with a change in tone at the top of Government potentially bringing about meaningful reforms to the way businesses are taxed. An improved business rates system would be an obvious way for new leadership to bring back the UK’s thriving highstreets and encourage consumer spending.”

CGA collected sales figures directly from 62 leading companies for the latest edition of the Coffer CGA Business Tracker.

Participating companies receive a fuller detailed breakdown of monthly trading. To join the cohort, contact Andrew Dean at andrew.dean@cgastrategy.com

About the Coffer CGA Business Tracker

Participants include: All Star Lanes, Amber Taverns, Anglian Country Inns, Azzurri Group (Ask Italian, Zizzi), Banana Tree Restaurants, Beds and Bars, Big Table Group (Bella Italia, Las Iguanas), Bill’s Restaurants, Boparan Restaurant Group (Carluccio’s, Gourmet Burger Kitchen), BrewDog, Buzzworks Holdings Group, Byron, Cityglen Pub Co, Coaching Inn Group Ltd, Cote Restaurants, Dishoom, Dominion Hospitality, East London Pub Co, Five Guys, Fuller Smith & Turner, Gaucho Grill, Giggling Squid, Greene King (Chef & Brewer, Hungry Horse, Flaming Grill), Gusto Restaurants, Hall & Woodhouse, Hawthorn Leisure, Honest Burgers, Junkyard Golf Club, Laine Pub Co, Le Bistrot Pierre, Liberation, Loungers, Marston’s, McMullen & Sons Ltd, Mitchells & Butlers (Harvester, Toby, Miller & Carter, All Bar One), Mowgli, Nando’s Restaurants, New World Trading Company, North Brewing Co, Oakman Inns, Parogon Pub Group, Peach Pubs, Pizza Express, Pizza Hut UK, Prezzo, Punch Pub Co, Rekom UK, Restaurant Group (Frankie & Bennys, Chiquitos, Brunning & Price), Revolution Bars, Riley’s, Rosa’s Thai, Snug Bar, Southern Wind Group (Fazenda), St Austell, Star Pubs & Bars, State of Play Hospitality, Stonegate Pub Co (Slug & Lettuce, Yates’, Walkabout, Bermondsey Pub Company), Tattu Manchester, TGI Fridays UK, The Alchemist, True North Brew Co, Upham Pub Co, Various Eateries (Strada, Coppa Club), Wagamama, Whitbread (Beefeater, Brewers Fayre, Table Table), YO! Sushi and Youngs.

About CGA by NielsenIQ:

CGA is the definitive On Premise measurement, insight and research consultancy that empowers the world’s most successful food and drink brands. With more than 30 years’ experience and best-in-class research, data and analytics, CGA is uniquely positioned to help On Premise businesses develop winning strategies for growth.

CGA works with food and beverage suppliers, consumer brand owners, wholesalers, government entities and pub, bar and restaurant retailers to protect and shape the future of the On Premise experience. Its mission is to use phenomenal data and expert insights to give brands a competitive edge and ensure the market we love is the most vibrant possible.

To learn more, visit: www.cgastrategy.com

Recent Reports:

- Managed groups’ like-for-like sales flat in May as cost crisis deepens

- Managed groups’ like-for-like sales up 2% in April, but cost pressures stunt growth

- Managed groups’ like-for-like sales up 4% in March, but inflation holds down growth

- Managed groups’ grow like-for-like sales by 3% in February, but cost stresses mount

- Managed groups’ January sales up 3% on pre-COVID-19 levels as restrictions ease